Learn what a Home Equity Line of Credit (HELOC) is, how it works, qualification requirements, interest rates, fees, and how it can benefit New York homeowners.

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit, commonly known as a HELOC, is like having a credit card that’s secured by your home’s equity. It allows you to borrow money against the value of your home, giving you access to funds when you need them. Think of it as a flexible loan option that can help you finance various expenses over time.

How Does a HELOC Work?

- Credit Limit Based on Home Equity: The amount you can borrow is determined by the equity you have in your home. Lenders typically allow you to access up to 85% of your home’s value minus any existing mortgage balance.

- Draw and Repayment Periods:

- Draw Period: This is the time frame, usually 5 to 10 years, during which you can borrow money as needed up to your credit limit.

- Repayment Period: After the draw period ends, you’ll enter the repayment phase, often lasting 10 to 20 years, where you’ll pay back the borrowed amount plus interest.

- Variable Interest Rates: HELOCs usually come with variable interest rates, which means your monthly payments can fluctuate based on market conditions.

How to Qualify for a HELOC

To be eligible for a HELOC, lenders consider several factors:

- Home Equity: You generally need at least 15-20% equity in your home.

- Credit Score: A good credit score (typically 620 or higher) increases your chances of approval.

- Debt-to-Income Ratio (DTI): Lenders prefer a DTI ratio below 43%.

- Stable Income: Proof of steady employment and income assures lenders you can repay the loan.

Maximum Amount You Can Get

The maximum amount depends on:

- Loan-to-Value Ratio (LTV): Lenders calculate your LTV by dividing your mortgage amount by your home’s appraised value.

- Equity Available: If your home is worth $500,000 and you owe $300,000, you have $200,000 in equity. With an 85% LTV, you might qualify for a HELOC of up to $125,000.

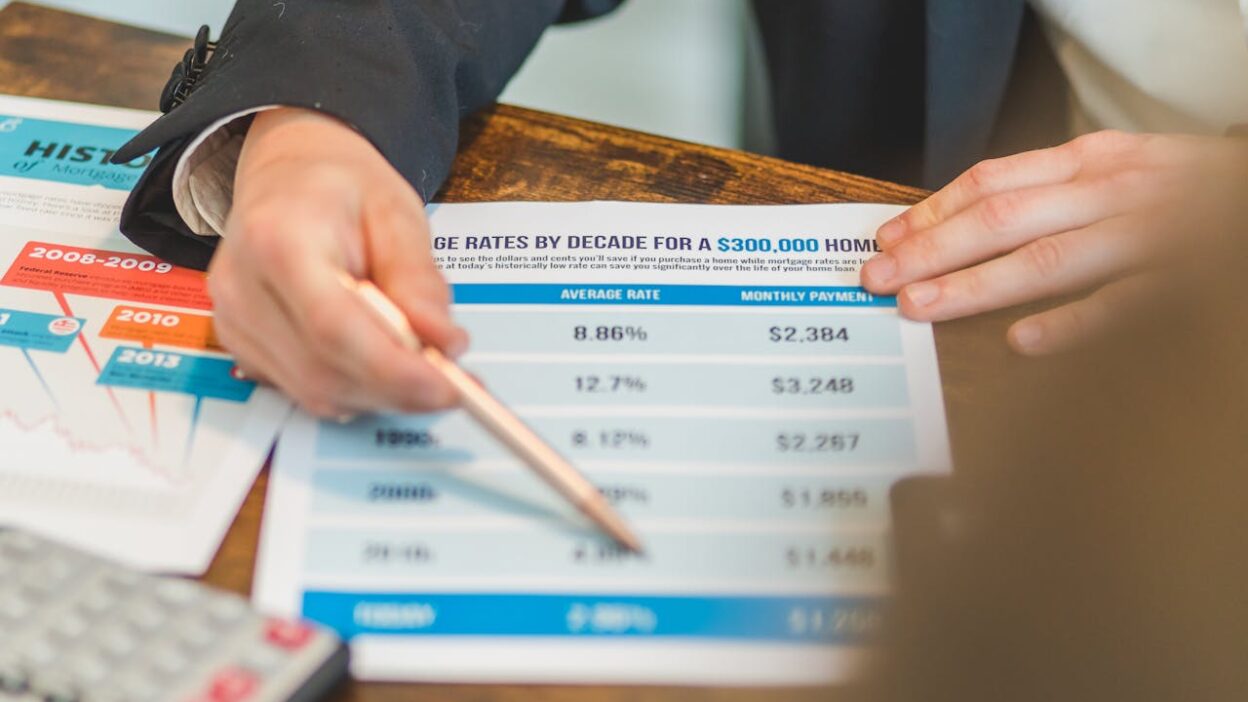

Interest Rates

- Variable Rates: Interest rates can change over time, affecting your monthly payments.

- Introductory Rates: Some lenders offer lower rates at the beginning, which may increase later.

- Rate Caps: There might be limits on how much your interest rate can rise over a specific period or over the life of the loan.

Fees Associated with a HELOC

Be prepared for potential fees, such as:

- Application Fee: Costs for processing your application.

- Appraisal Fee: Charges for assessing your home’s value.

- Annual Fee: Yearly charges to maintain the HELOC.

- Transaction Fees: Fees for each draw from your HELOC.

- Early Closure Fee: Penalties if you close your HELOC early.

What Can a HELOC Help You Do?

A HELOC provides financial flexibility for:

- Home Improvements: Renovate or upgrade your home.

- Education Expenses: Pay for college tuition or other educational costs.

- Debt Consolidation: Combine high-interest debts into one lower-interest payment.

- Emergency Funds: Cover unexpected expenses or medical bills.

New York-Specific Considerations

If you’re a New York homeowner, keep in mind:

- Mortgage Recording Tax: New York charges a tax on new mortgages, including HELOCs, which can increase your upfront costs.

- Co-op Properties: Obtaining a HELOC on a co-op may have additional requirements and restrictions.

- Regulatory Protections: New York has strict lending laws to protect consumers, which may affect terms and disclosures.

A HELOC can be a valuable tool for managing your finances and leveraging your home’s equity. By understanding how it works and what to expect, you can make informed decisions that benefit your financial future.